Investors have been trying to get back on their feet from the massive hit they took thanks to COVID-19. And it seems new opportunity zone regulations may be just what the doctor ordered.

Investors have been trying to get back on their feet from the massive hit they took thanks to COVID-19. And it seems new opportunity zone regulations may be just what the doctor ordered.

New Deadlines For OZ Investments

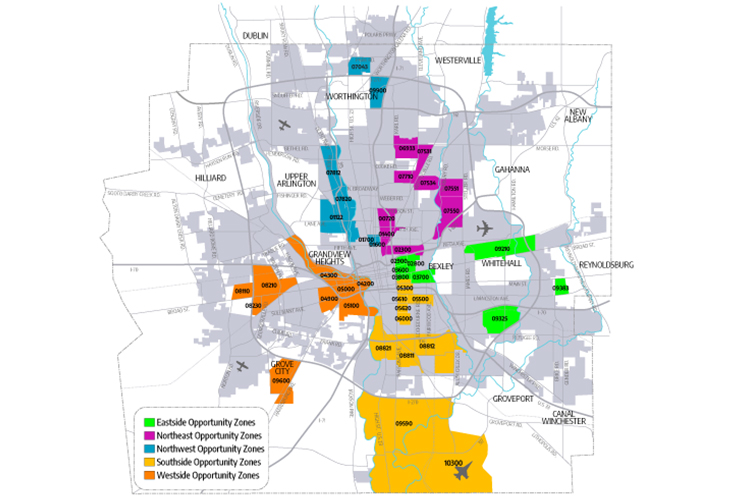

Opportunity zones were created by the Tax Cuts and Jobs Act of 2017 to encourage investors to put capital into specific real estate and business tracts. Qualified Opportunity Funds (QOF) allow investors to put their money to work in these areas.

The IRS recently released Notice 2020-39, which provides new deadlines for investments in opportunity zones to pique investor interest in distressed properties – particularly those impacted by COVID-19.

The new regulations:

- Support increasing investor interest in locating distressed assets created by the pandemic

- Help investors navigate a reliable investment to put their money into and deploy capital gains

- Allow investors more time to acquire and improve distressed assets in opportunity zones

- Allow previously stalled deals to proceed

Investor Interest In QOZBs

Notice 2020-23, which took effect in April, provides investors incentives geared toward opportunity zones, including new reinvestment rules and a capital safe harbor.

Reinvestment rules: The reinvestment rule stipulates QOFs now have a cushy 12-months to reinvest capital incurred from opportunity zone asset sales into a new asset. This new timeline has been extended in part because of COVID-19. QOFs must continue to invest proceeds as planned if their transaction began before the pandemic.

Capital safe harbor: QOFs now have more than two additional years to provide a working capital safe harbor that allows opportunity zone businesses to utilize that capital. This is due to opportunity zone businesses being impacted by temporary closures and the economic turbulence caused by social distancing.

Opportunity zone businesses will have up to 24 months to utilize working capital assets if they are in a federally declared disaster area and have been affected by COVID-19.

Advantages Of Opportunity Zones

- No capital gain tax from appreciation: Appreciation incurred on QOFs held for ten years or more are not subject to capital gain taxes.

- Reduction in deferred capital gain: You may receive up to 10% reduction in deferred capital gains if you’ve held an investment for five years before the end of December 2026.

- Tax deferral: Defer invested capital gain until the end of 2026 or until the QOF is sold.

Our investment team at DRK And Company is committed to helping you navigate the labyrinth created by COVID-19. Call 614-540-2404 or contact us online to learn more about our services.